The Royal Armoured Corps Memorial Trust

A very informative article about the RAC Memorial Trust from the Chairman, John Colton. Published August 2023.

The RAC Memorial Trust (RAC MT) was formed originally as the Royal Armoured Corps War Memorial Benevolent Fund, in 1946 following the end of the Second World War, by veterans of that conflict.

It was established for three purposes:

So important was the contribution of the Royal Armoured Corps in securing final victory in World War II that both Sir Winston Churchill and Field Marshall Viscount Montgomery of Alamein, two of its first patrons, were willing to put their names to a letter endorsing the creation of this Benevolent Fund.

Currently, the Trust is honoured to enjoy the support of HRH The Duke of Kent as its patron. The Duke himself served with the Royal Scots Greys for over 20 years.

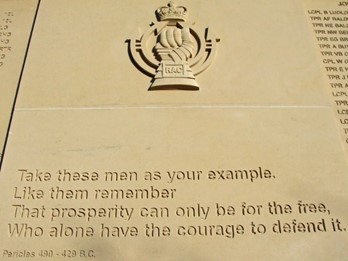

One essential way in which the Memorial Trust meets these original objectives has been to compile a comprehensive Roll of Honour, recording the details of all 12,619 officers and soldiers who have died whilst serving in the Royal Armoured Corps, since its formation in 1939 right through to the present day.

This Roll of Honour is contained in four Books of Remembrance, which are displayed in the RAC Memorial Room, located in the WW2: War Stories exhibition.

These Books of Remembrance form the very soul of the Royal Armoured Corps. By safeguarding them and exhibiting them in this way, the Trust continues to honour the original intent of the Fund, which, as the first patrons’ letter clearly stated, was to “provide a visible memorial where the names of all the Fallen of the Corps shall be recorded.”

Although many of the Corps’ original units no longer exist, the benevolence goals enshrined within the Trust’s original objectives are still as relevant today as they were when the Fund was first created.

The RAC Memorial Trust continues to support retired and serving soldiers, their spouses and families, and the spouses and families of those who have died in service, when in need.

The Trust is able to pledge a sum up to the amount offered by the individual regiment or, if that regiment no longer exists, the Trust may take on full responsibility for supporting the individual. Further support is regularly made available from the Army Benevolent Fund (ABF), the Royal British Legion (RBL), or other military and civilian charities, co-ordinated by the individual’s case worker.

Requests are many and varied. Sadly not all demands can always be met and we are unable to assist in resolving debt issues. However, for instance, the Trust has proudly supported the purchase of mobility aids, the replacement of household items, the provision of special educational needs as well as individual health care treatments not fully covered by the NHS.

In order to ensure we can, where appropriate, provide support quickly, please do not contact the Trust directly in the first instance, as this will only slow the immediate response.

If you are a:

or

or

Please note that in order for the Trust to provide support, each request needs to be accompanied by a written confidential report. Either SSAFA or RBL provides the Trust with this background information to the case. Therefore, it is important to contact SSAFA or RBL in the first instance, in order to speed up the Trust’s ability to provide appropriate assistance.

In this vital work the Trust continues to honour the clearly defined aims of the original Fund, as stated by its first patrons:

“The ultimate intention is that no officer or man who at any time serves in the Royal Armoured Corps, or his dependants, shall go without help if in need.”

THE ROYAL ARMOURED CORPS MEMORIAL TRUST (RACMT) TERMS FOR A MILITARY EFFICIENCY GRANT

The application form for a military efficiency grant can be opened by clicking this link. Please save it to your device and follow instructions set out in the form.

7 Dec 2023 V1.2

You can donate and gift aid it by visiting Donate to The Royal Armoured Corps Memorial Trust | Wonderful.org.

There is also the option of leaving a lasting legacy to the Trust as described below.

Five steps to leaving a lasting legacy to the Royal Armoured Corps Memorial Trust

In order to advise on preparing your will, you will need to consider the value of your estate including any assets held abroad and who you wish to benefit under your will. If in doubt we advise you to consult with a solicitor.

Your solicitor will be able to advise you on your available options and help you to decide the most appropriate type of legacy gift to leave to the Royal Armoured Corps Memorial Trust.

The three basic types of legacy are:

Many people choose to leave the Trust a residuary gift because it keeps pace with inflation and allows you to ensure your loved ones are well looked after first and foremost.

Any amount you leave to charity will usually be exempt from Inheritance Tax (IHT). The standard Inheritance Tax rate is 40% but if you decide to leave 10% or more of the ‘net value’ of your estate to charity, a reduced rate of 36% may apply. The net value of your estate is the total value as at the date of your death of all your assets minus any debts. Not all estates are subject to Inheritance Tax (IHT) but it is important that you consider and discuss your tax position with your solicitor.

Your will is an important and personal document. A free will service, available from some solicitors, is suitable for most simple wills and estates. However, we recommend The Law Society (www.solicitors.lawsociety.org.uk) or STEP (www.step.org) for more information on finding a reputable solicitor local to you.

“We will remember them”